2025-07-28 22:20

周末消息面影响下周市场。人工智能大会超预期,我国倡议成立全球人工智能合作组织,总部拟设上海,或加大产业链投入,上海本地AI产业链或率先反馈,相关概念股如云赛智联等受关注;上海发放全国首批智能网联汽车示范运营牌照,自动驾驶商业化开启利润叙事。机器人方面,宇树发布3.99万元R1轻量版人形机器人,有望带动新行情。基孔肯雅热疫情在广东加剧,相关驱蚊、检测、药物等概念股下周或强化加速。水电站、去内卷相关行业周五分歧或被降温,关注后续反馈。

股票名称 ["直真科技","云赛智联","数据港","宝信软件","城地香江","浦东金桥","张江高科","上汽集团","百度智行","小马智行","文远知行","大众交通","锦江在线","建设机械","长盛轴承","中大力德","彩虹集团","润本股份","诺普信","扬农化工","小崧股份","嘉亨家安道麦A","达安基因","万孚生物","仁度生物","明德生物","易瑞生物","硕世生物","英诺特","透景生命","博拓生物","海正药业","上海凯宝","康缘药业","东方生物","新诺威","智飞生物","沃森生物","康希诺生物","义翘神州","金域医学","振东制药"]板块名称 ["人工智能","机器人","基孔肯雅热概念","水电站","去内卷相关行业"]人工智能大会、机器人利好、基孔肯雅热疫情看多看空 内容中既有对人工智能、机器人等板块的积极预期,如人工智能大会带来的超预期因素和机器人新利好可能带动行情;也有对水电站、去内卷相关行业的负面看法,如水电站舆情不高、去内卷行业周五被暴捶。同时指出大盘缓涨但短期有隐患,综合来看对A股的态度是中性。 深夜突袭,全线跌停和讯自选股写手风险提示:以上内容仅作为作者或者嘉宾的观点,不代表和讯的任何立场,不构成与和讯相关的任何投资建议。在作出任何投资决定前,投资者应根据自身情况考虑投资产品相关的风险因素,并于需要时咨询专业投资顾问意见。和讯竭力但不能证实上述内容的真实性、准确性和原创性,对此和讯不做任何保证和承诺。

深夜突袭,全线跌停和讯自选股写手风险提示:以上内容仅作为作者或者嘉宾的观点,不代表和讯的任何立场,不构成与和讯相关的任何投资建议。在作出任何投资决定前,投资者应根据自身情况考虑投资产品相关的风险因素,并于需要时咨询专业投资顾问意见。和讯竭力但不能证实上述内容的真实性、准确性和原创性,对此和讯不做任何保证和承诺。本文由 AI 算法生成,仅作参考,不涉投资建议,使用风险自担

分享至:

文章来源:

未知

相关阅读

多板块行情分析与A股走势

2025-07-28 22:20:01

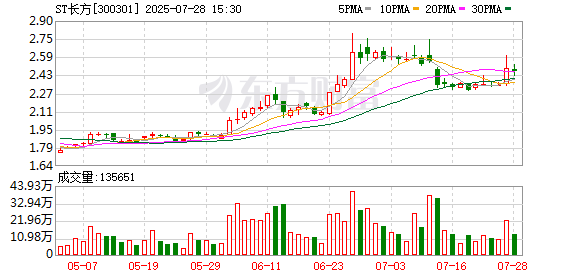

ST长方:刘志刚、江玮、姜

2025-07-28 22:10:02

指数震荡回落,短线情绪

2025-07-28 21:40:01

Labubu爆火、泡泡玛特业绩

2025-07-28 20:50:19

虽面临前高套牢盘压力,

2025-07-28 20:20:01

看好科技线、反内卷线和

2025-07-28 20:10:01

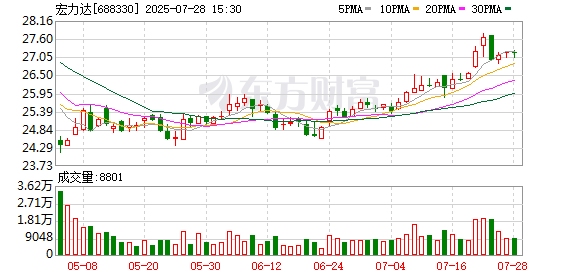

宏力达:7月28日召开董事

2025-07-28 20:00:01

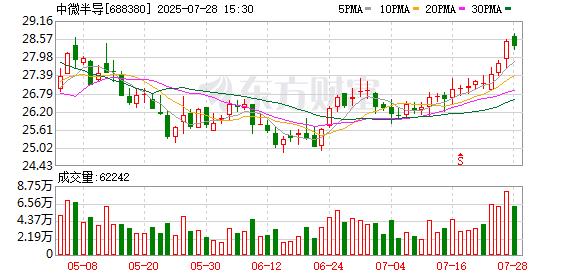

中微半导:约2128.5万股限

2025-07-28 19:50:01

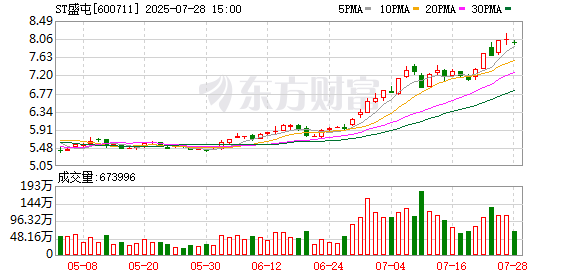

ST盛屯7月28日大宗交易成交

2025-07-28 19:30:02

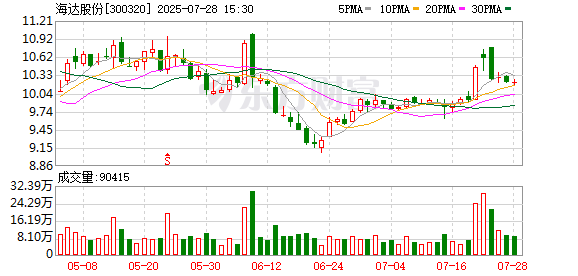

海达股份副总经理吴天翼

2025-07-28 19:10:02