2025-08-11 21:00

今日市场量能18270亿,较昨日放量1167亿,上涨家数3999家,涨停78家。上证与创业板共振修复,中小微盘股表现突出,赚钱效应较好。情绪上普反修复,高位辨识度品种更主动,但修复略显高潮,明日大概率分化。指数距去年高点一步之遥,预计继续箱体盘整。板块方面,科技品种弹性高,包括AI和创新药,基建也有赚钱效应,资金青睐硬逻辑品种。短线能量聚集在长城军工、大族数控等。日内强势板块众多,如机器人、锂电池、算力等,各有相关消息催化。整体来看,高位品种反馈良好,仍以逻辑趋势风格为主,连板最高3b。

股票名称 ["长城军工","大族数控","东芯股份","北纬科技","中欣氟材","君禾股份","荣泰健康","视源股份","金发科技","振邦智能","超捷股份","江特电机","金鹰股份","盛新锂能","天齐锂业","同洲电子","赣锋锂业","莱尔科技","美丽生态","华胜天成","奥瑞德","美格米特","康盛股份","大元泵业","欧陆通","威尔高","洪田股份","海立股份","万通发展","电科芯片","新疆交建","北新路桥","八一钢铁","天顺股份","新疆火炬","国统股份","青松建化","西部建设","美诺华","启迪药业","塞力医疗","易明医药","振东制药","野马电池","中恒电气","麦格米特","可立克","潍柴重机"]板块名称 ["机器人","锂电池","算力","芯片","新藏铁路","医药","服务器电源"] 市场修复、板块分化、科技品种看多看空(中性) 今日市场集体修复,但修复略显高潮,把能修复的筹码一天用完,明天大概率分化;指数距离去年高点一步之遥,个人认为不会轻易突破,会继续做箱体盘整,整体处于一种多空因素交织的状态,所以持中性态度。 什么样才算硬逻辑?和讯自选股写手风险提示:以上内容仅作为作者或者嘉宾的观点,不代表和讯的任何立场,不构成与和讯相关的任何投资建议。在作出任何投资决定前,投资者应根据自身情况考虑投资产品相关的风险因素,并于需要时咨询专业投资顾问意见。和讯竭力但不能证实上述内容的真实性、准确性和原创性,对此和讯不做任何保证和承诺。

什么样才算硬逻辑?和讯自选股写手风险提示:以上内容仅作为作者或者嘉宾的观点,不代表和讯的任何立场,不构成与和讯相关的任何投资建议。在作出任何投资决定前,投资者应根据自身情况考虑投资产品相关的风险因素,并于需要时咨询专业投资顾问意见。和讯竭力但不能证实上述内容的真实性、准确性和原创性,对此和讯不做任何保证和承诺。

分享至:

文章来源:

未知

相关阅读

什么样才算硬逻辑?

2025-08-11 21:00:02

重点关注是否会走出三浪

2025-08-11 20:40:29

A股牛市热火,看多情绪显

2025-08-11 20:20:06

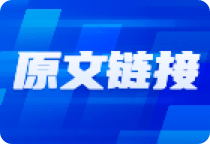

气派科技上半年营收同比

2025-08-11 20:10:01

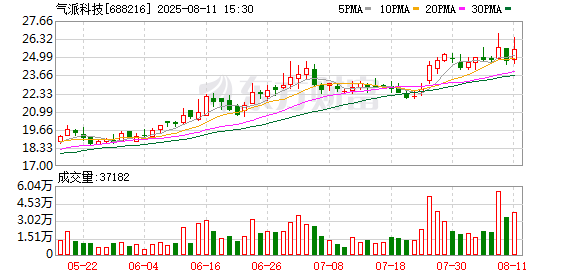

专用设备行业董秘观察:

2025-08-11 19:20:02

湘电股份2亿收购背后:近

2025-08-11 19:00:04

洁美科技:8月8日召开董事

2025-08-11 18:50:02

烧碱:山东碱厂旺季信心

2025-08-11 18:40:02

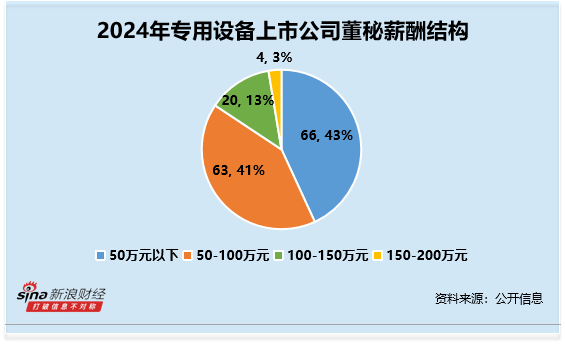

高盛:升中国铁塔目标价

2025-08-11 18:00:01

如何在期货市场中保持长

2025-08-11 17:50:01